Start-ups have been my area of interest ever since I took my first class in Small Business Management (SBM). The interest grew stronger throughout my education and practical experience and last January I published my first book on SME Start-ups prior and after the financial crisis. What I found interesting was that Sweden and Luxembourg were the only countries from the old member states in which entrepreneurs showed resilience during the 2008 Financial Crisis (FC). Namely, the number of new businesses in the post crisis period decreased for 8% on EU level in comparison with pre-crisis levels while Sweden was experiencing an increase on start-up activity.

In a period of stagnation, defaulting and contracting European markets, Sweden was thriving.

What did Sweden do right? Where did the rest go wrong?

Despite the fact that the 2008 FC produced many necessity-driven entrepreneurs which were forced into self-employment due to lack of job opportunities, Swedish entrepreneurs were pulled into the market by a business opportunity and voluntarily engage in business (GEM, 2012). This may be one of the reasons for higher survival rates of start-ups in Sweden in comparison to other member states.

No question about it, Sweden is and has been the new rising start on the horizon.

Small companies from this Nordic country are creating trends rather than following the footsteps of big companies. Skype, Spotify and Candy Crush are only few examples of start-ups which altered the way we communicate, exchange information or entertain ourselves.

In an era of disruptive technology and digitization, Sweden is taking the lead in Europe with 6.3 billion-dollar tech companies per million people. Actually this Scandinavian country is the second most resourceful tech hub in the world, right after the Silicon Valley.

So, what makes Sweden – The Silicon Valley of Europe?

Global outlook from the start!

Scholars have argued that companies operating in small markets away from the epicentre of innovation like the Silicon Valley and physically away from demanding customers are highly disadvantaged. The Uppsala model vouches for gradual international expansion and ignores successful stories like “Born Global” companies identifying them as accidental success. But, in today’s interconnected and digital world, they are becoming more the rule, rather than the exception.

In contrast, Sweden thrived because of, not in spite of, its small market. Swedish companies have an international business perspective from the very beginning. Statistics shows that Swedish company expands internationally twice as fast in comparison to a company from another European country with similar population and market to Sweden. Although, proposed by Swedish researchers (Johanson & Vahlne, 1977) the Uppsala model of gradual expansion does not apply here.

Companies today operate in an interconnected, digital economy. CEOs are crossing borders with a few clicks on their iPods and having international conference meetings not making a single step. The World Economic Forum has recognized Sweden as the world’s most digital economy (2010). This country based their growth on innovation and disruption, simply creating the unknown.

Nevertheless, the US still outperforms Europe when it comes to new business formation and innovative start-ups. Facebook, Google, Apple and Amazon have all been born in the US. Although Europe has almost twice the population of the US, it has relatively less success stories in the tech industry. “Statistically, this’s an anomaly” (The Telegraph, 2015).

What can European start-ups learn from the US? What can Swedish entrepreneurs learn from the Silicon Valley?

Companies from the Silicon Valley, even start-ups have accepted globalization as way of life!

From the very beginning they are capitalizing on opportunities that the interconnected and digital economy of today’s global world has enabled. They take advantage of communication technologies for cutting costs and increasing efficiency.

They started with shifting manufacturing with iPods, Xboxes, iPhones, iPads and other smartphones and tablets manufactured in China or other Asian countries. Over time, oversees jobs shifted from non-skilled towards more IT-oriented jobs send particularly in India. Cisco was one of the companies to discover the potential of India which back in 2006 invested $1.2 billion in Bangalore.

Although there has been some controversy on how the offshoring affects the job market in the US, today, US companies are hanging on to the high-skilled work that requires face-to-face interaction, while everything that can be done “over the wire” gets shipped offshore. They stay competitive through constant innovation and development freed from routinized and distracting tasks.

In the simplest way said they do what they are best at and outsource the rest!

If India is the frontier for US companies where is the best location for outsourcing for Swedish start-ups?

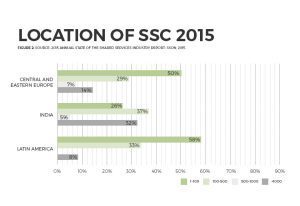

For a long time, India was the frontier for outsourcing especially for large US companies in the IT sector. As we can see from Figure 1, India dominants only among large corporations which we can say represent the first wave of outsourcing and shared service centres. Recently, companies have turned towards more nearshore alternatives seeking for transformation and improved business performance. Start-ups especially are looking for someone with whom to build partnership step by step rather than taking the “The Big Bang” approach. More importantly, the Shared Services and Outsourcing Network (SSON) has found that outsourcing providers from the CEE region are accepted as “part of the extended team” in contrast to being seen as external partners.

If the companies from the newly emerged regions want to retain their competitive edge must find their niche market. For example, focusing on a geographic niche market provides vendors with better understanding of the region’s regulatory controls and protocols. Furthermore, it increases its audit readiness and better equips teams to define and address challenges.